X

Zero Interest Loans For The People By The People

In partnership with Kiva, WEPOWER helps make capital more accessible to small business owners, particularly those who have been excluded by the mainstream financial system.

Entrepreneurs of color face direct discrimination and structural racism, resulting in less access to capital, compounding existing inequities and making it harder for communities of color to build generational wealth. Research has shown that Black entrepreneurs are rejected for loans at higher rates, on average approved for lower loan amounts, and charged higher average interest rates. It’s time to address these barriers.

Borrow Funds to Fuel Your Dreams

“Reality is wrong. Dreams are for real.” – Tupac

Zero interest. Zero fees. Grace period. Access a loan between $1,000-$15,000. Kiva acts as a first-rung on an otherwise inaccessible financial ladder, creating an important new path to the financial mainstream.

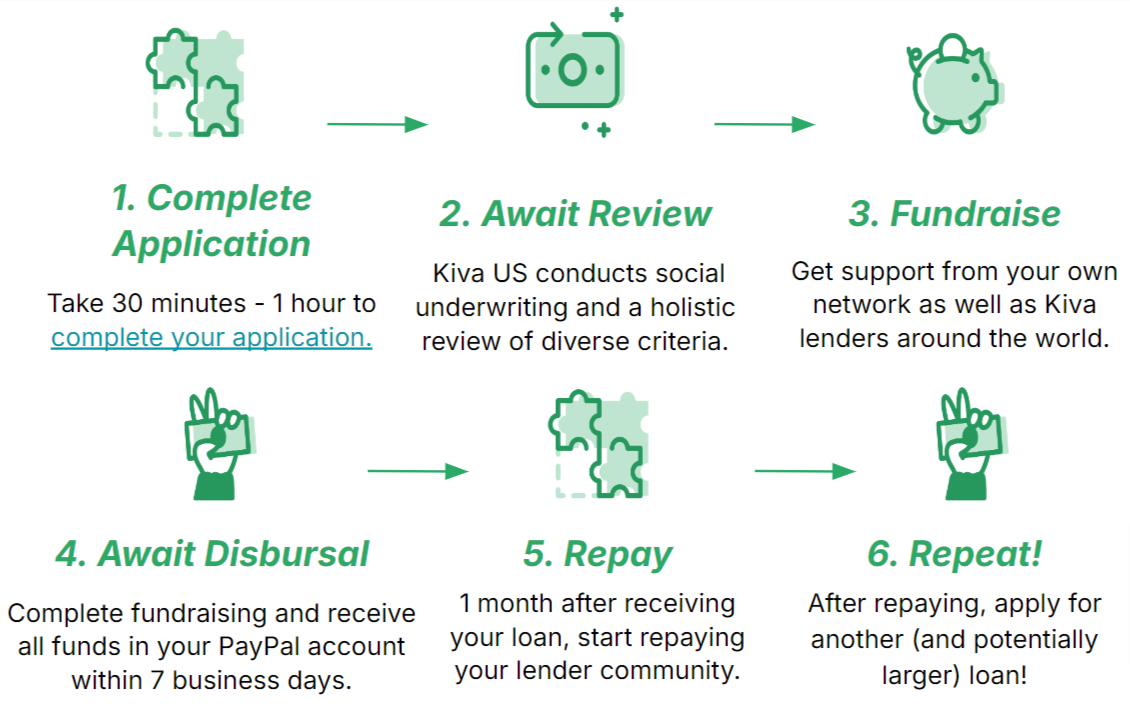

How the Loan Works

About Kiva

Kiva U.S. is an online lending platform committed to broadening access to inclusive and risk-tolerant capital throughout marginalized and unbanked communities across the United States. At its core, Kiva mobilizes public support via crowdfunding to establish a direct avenue of capital for entrepreneurs. The platform utilizes an inclusive, community-driven underwriting process to evaluate creditworthiness, which considers factors such as social capital, trust networks, alongside traditional measures.

Kiva Loans

- $1,000 - $15,000

- 0% interest

- Zero fees

- Up to 36 month terms

- Supported by ~120 crowd-lenders per loan

- No minimum credit score or collateral requirements

- Over 75M disbursed to US entrepreneurs since 2011

Minimum Requirements

- Must be 18 years of age

- Must be living in and your business must be operating in the U.S.

- Kiva operates in all states and territories except Nevada, North Dakota, and Vermont

- Must use this loan for business purposes

- Must have a PayPal account

- Cannot currently be in bankruptcy

- Must provide some financial information, usually a State Filing, an Employer Identification Number (EIN), or a business number

For more information, visit kiva.org/borrow/wepower or email Saida Cornejo Zuñiga at [email protected].