WEPOWER Capital

Capital That Works for Companies and Communities

WEPOWER Capital accelerates community-owned wealth generation in North St. Louis communities that have experienced decades of divestment by investing in high growth Black and Latinx businesses.

Our Region is Missing Out on a Major Opportunity to Advance Racial Equity & Build Wealth

An investment in Black and Latinx entrepreneurs is an investment in our region’s collective prosperity. Black and Latinx entrepreneurs create jobs at the same rate or higher than white owned firms. However, our systems weren’t designed for Black and Latinx entrepreneurs or communities to thrive.

- Traditional Capital Denied: Black and Latinx entrepreneurs are more likely to be denied bank loans, offered less capital when approved, and charged higher interest rates.

- Soaring Racial Wealth Disparities: Given the massive racial wealth gap -- white families have 10-20x the wealth of Black families --most Black and Latinx entrepreneurs do not have access to anyone who will make an early investment of $30,000, let alone $100,000.

- Pandemic Hits Harder: Nationwide, the number of Black owned businesses dropped by 41% between February 2020 and April 2020.

It Is Time to Reimagine The Role of Capital

We cannot reach our potential as a region without fully investing in Black and Latinx communities and the businesses that can drive their economic mobility.

It is time to provide access to capital to Black and Latinx businesses that have the potential to spark wealth for their families and their communities.

Founder-Friendly, Flexible “Capital+” That Builds Community Wealth

This is not your run of the mill investment fund. We provide “capital+” (i.e. capital plus connections and technical assistance), with a mission to spark place-based economic prosperity.

WEPOWER Capital uses revenue based investing, where entrepreneurs repay a fixed percentage of their revenue until a pre-agreed total has been paid back. This model is more flexible than traditional loans, allowing us to truly share risk with entrepreneurs and only succeed when they do, without reducing their ownership in their company.

- Vehicle: Revenue share agreements & loans

- Check size: $50,000 - $200,000

- Return cap: 1.5x, based on business profile

- Revenue share: ~2-10% of monthly revenue

- Collateral: Not required

- Credit Score: Not required

For Fast Growing,

Black and Latinx

Owned Companies

We are looking for:

- Black and Latinx owned companies

- Anywhere between $5,000-100,000/month (or more) in revenue

- Strong growth trajectory (or evidence of strong growth potential with investment)

- Companies committed to hiring at or above a living wage or, at minimum, putting workers on a path to a living wage

- Companies committed to hiring in and/or locating in priority neighborhoods, St. Louis city wards 3 and 21, that have experienced generations of disinvestment

Building Community Wealth Triples Impact

A percentage of the returns will be owned and managed by the surrounding community and the rest will be invested in future.

With this innovative model, the impact is three-fold. WEPOWER Capital catalyzes Black and Latinx owned businesses to:

- Anchor neighborhoods

- Build the tax base

- Accelerate community owned shared wealth generation that disrupts generational divestment

Join Us!

Updates

Paula Vickers | Grandma’s Plan

Friday, August 18th at Missouri’s Botanical Garden, WEPOWER hosted their second ever Garden Party. Paula Vickers shared her journey with WEPOWER and what’s to come. Paula is a graduate of the 2023 cohort of WEPOWER’s Chisholm’s Chair Fellowship and serves as WEPOWER’s fulltime Early Childhood Community Organizer. August 18, 2023 Paula Vickers | Grandma’s Plan…

LaParis Hawkins | The Renaissance

Friday, August 18th at Missouri’s Botanical Garden, WEPOWER hosted their second ever Garden Party. LaParis Hawkins shared her journey with WEPOWER and what’s to come. LaParis is a graduate of the 2023 cohort of WEPOWER’s Chisholm’s Chair Fellowship and the founder and owner of Tailored Pieces. August 18, 2023 LaParis Hawkins | The Renaissance LaParis…

WEPOWER launches special collab!

WEPOWER launches special collab! August 9, 2023 Nine years ago today, 18-year young Michael Brown Jr. was murdered. The Ferguson Uprising ignited, and uprisings all across the globe ignited in solidarity. Our region and world will forever be changed. Yet, our work as a region isn’t done; it can’t be. #mikebrownforever means WE have a…

WEPOWER Announces Nearly $200,000 Investment in Local Businesses, RooterMan Franchisee and Cheryl’s Herbs

August 3, 2023 WEPOWER Announces Nearly $200,000 Investment in Local Businesses, RooterMan Franchisee and Cheryl’s Herbs RooterMan and Cheryl’s Herbs mark WEPOWER Capital’s second and third investments, with the goal to accelerate community owned wealth and create economic growth in historically divested communities. As WEPOWER Weekend approaches, WEPOWER Capital announces another reason to celebrate: their…

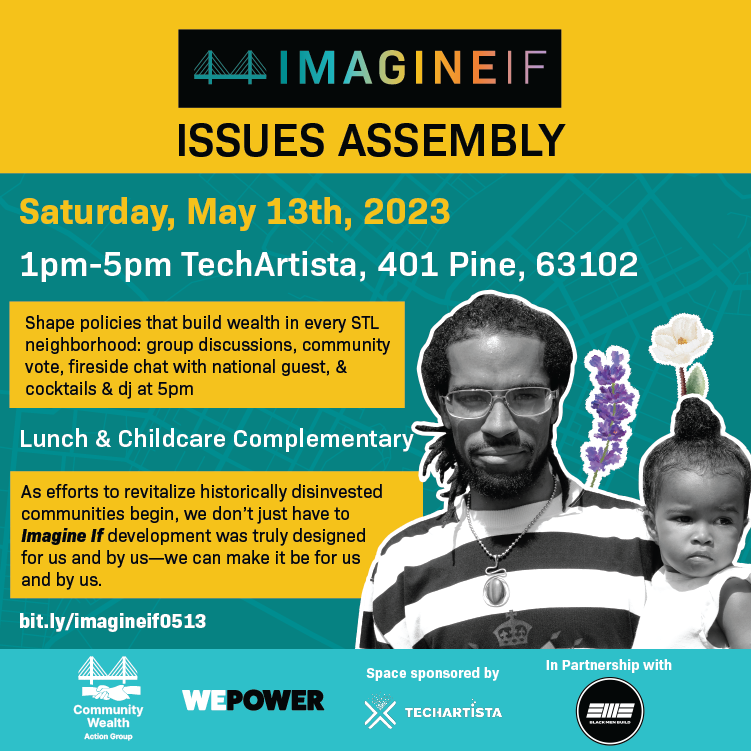

Last Night We Won + Today We Build – Join Us April 13th and May 13th!

April 10, 2023 Last Night We Won + Today We Build – Join us April 13th and May 13th! Over the past couple of months, we’ve knocked on 5,000+ doors, texted 85,000 voters, and had hundreds of community convos. Last night, the WEPOWER team went to bed tired, but the good kind of tired –…

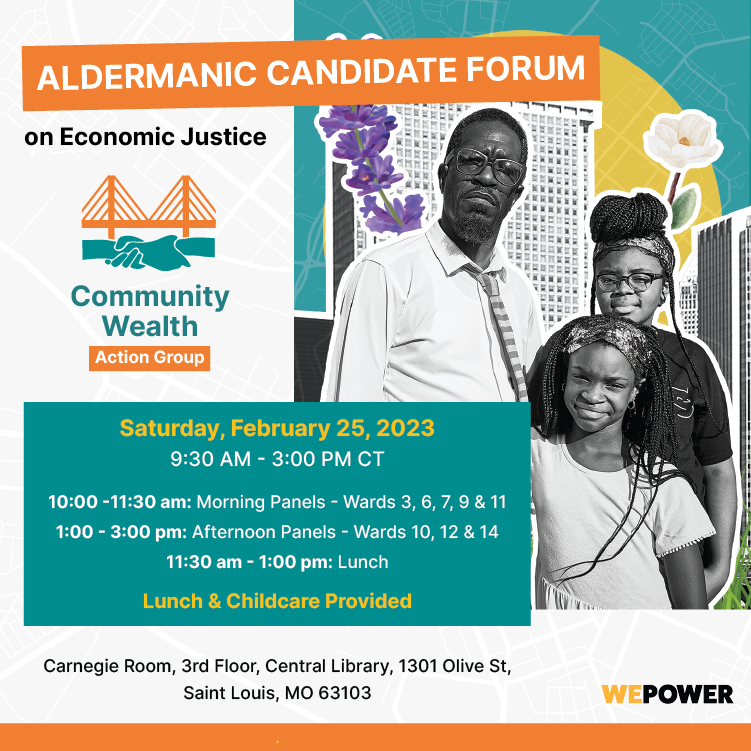

Community Benefits Agreements emerge as top issue in Spring 2023 election cycle

February 20, 2023 Community Benefits Agreements emerge as top issue in Spring 2023 election cycle A new group of more than 100 residents, developers, business owners, philanthropists, and local organizations have announced the Community Wealth Action Group to advocate for community-owned wealth, quality jobs, and livable wages for Black and Latinx residents of St.…